Buying or owning a home in San Diego means keeping an eye on the market. One of the most common numbers you’ll see is year-over-year (YOY) appreciation. But what does it really mean?

YOY appreciation measures how much home values have changed over 12 months. For example, if San Diego’s median home price was $850,000 last year and $900,000 this year, that’s about a 6% increase.

But here’s the catch: real vs. nominal appreciation.

- Nominal = The raw increase (6% in this case).

- Real = The increase after adjusting for inflation. If inflation was 3%, your real gain is closer to 3%. (Nominal appreciation – Inflation rate)

Why it matters:

- Homeowners: Know your true equity growth.

- Buyers: Understand affordability beyond the headlines.

- Investors: Calculate real returns, not just flashy numbers.

In San Diego, home prices often rise faster than inflation — but not always. Knowing the difference between real and nominal appreciation can help you make smarter real estate decisions.

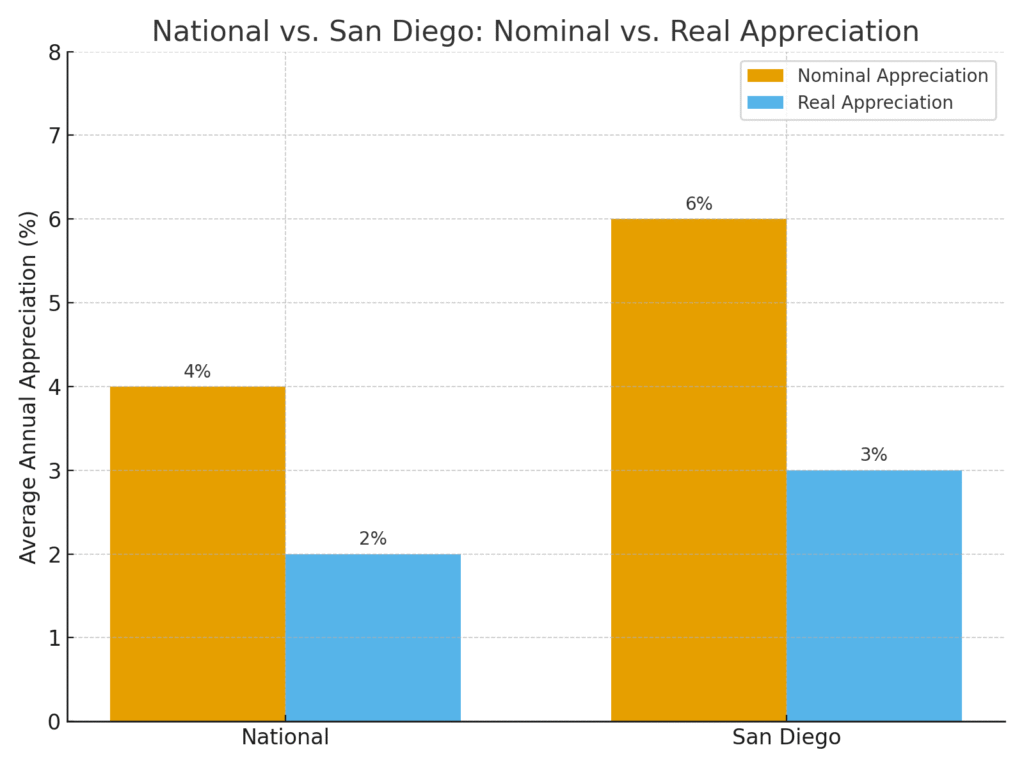

San Diego vs. National Appreciation: Nominal vs. Real

When talking about appreciation, it’s important to separate:

- Nominal appreciation → The raw increase in home prices.

- Real appreciation → The increase after adjusting for inflation (the “true” growth in buying power).

National Average (Long-Term)

- Nominal appreciation: ~3–5% per year

- Real appreciation: ~1–3% per year (inflation usually eats up part of those gains)

San Diego Average (Long-Term)

- Nominal appreciation: ~5–7% per year

- Real appreciation: ~2–4% per year

Why San Diego does better than the national average:

- Geography – Ocean, military bases, canyons, and mountains limit new construction.

- High demand – Desirable climate, strong job centers (biotech, military, universities, tourism).

- Tight supply – Zoning restrictions and slower building permits keep inventory low.

In plain English:

- Across the U.S., a typical home might grow 3–5% a year (nominal), but only 1–3% after inflation.

- In San Diego, homes more often grow 5–7% a year (nominal), which translates to 2–4% real gains after inflation.

- That extra bump is why San Diego real estate is seen as a stronger long-term investment compared to the national average.